Rob Fluty

Your Mortgage QB

NMLS#1067208

Loan

Programs

Conventional Fixed Rate Mortgages

Unlock the door to homeownership with a mere 3% down:

Conventional fixed-rate mortgages are the silver bullet for first-time buyers seeking both affordability and predictability in their financial planning. These mortgages not only open the gates to your dream home with minimal upfront investment but also shield you from the unpredictability of fluctuating markets with consistent monthly payments. Secure your slice of the American dream today with a financial strategy that offers stability, predictability, and the joy of

homeownership without the stress of market volatility."

Button

Adjustable-Rate Mortgages (ARM)

Adjustable-Rate Mortgages: Your Gateway to

Homeownership or a Risky Gamble?

Adjustable-rate mortgages (ARMs) offer an enticing path to

homeownership with initial low-interest rates. But, as economic tides change, so do your payments, potentially rising unexpectedly. ARMs are a double-edged sword: they can unlock the door to buying a home or challenge your budget with fluctuating rates. Before you decide, understand the terms, rate caps, and how they align with your financial future. Are you ready to navigate the ARM landscape with confidence? Dive into our comprehensive guide to make an informed choice and secure your financial stability. Click here to learn more and turn knowledge into your greatest asset in homeownership.

FHA Mortgage Loans

Dreaming of homeownership but feeling held back by a slim savings account or less-than-perfect credit? Enter the realm of FHA mortgages—your gateway to buying your first home with just 3.5% down and a credit score of 580. This isn't just a loan; it's your bridge to a future where your home is more than a dream. Discover how FHA mortgages are turning the tide for first-time homebuyers, offering an affordable path to the keys of your very own home. Embrace this chance to transform your homeownership dream into a reality with less upfront cost and more understanding of your financial journey.

VA Mortgage Loans

Think you can't own a home with a credit score as low as 500 or no down payment? Think again! VA home loans are changing the game for veterans, offering a path to homeownership that many don't realize they have. Don't let this powerful benefit go to waste. Discover how you can step into your dream home with zero down. It's not just a loan; it's your right as a hero. Dive into the untapped potential of VA home loans and turn the key to your future, today!

Refinance Mortgage Loans

Considering the intricacies of refinancing in today's

fluctuating market, it's pivotal to understand not just the immediate benefits but also the long-term impact on your financial health. In a landscape where interest rates are unpredictably high, and many homeowners are comfortably

settled into lower rates, the prospect of refinancing into a disadvantageous higher rate might appear counterintuitive. Yet, this move could be a meaningful change for many, offering not just a reduction in monthly expenses but also paving the way for significant financial liberation. By leveraging the equity in your home through cash-out refinancing or consolidating debt, you could unlock a pathway to diminish your financial burdens by hundreds of dollars monthly, despite the higher interest rates. This strategic financial maneuver not only promises immediate relief in terms of reduced monthly outlays but also aligns with a broader vision of financial stability and freedom, making it a compelling consideration for homeowners looking to optimize their financial trajectory in a challenging market.

Home Equity Loans

Transform Your Home Equity into Your Financial Swiss Army

Knife: Why let the equity in your home gather dust when it could be your golden ticket to financial flexibility? A Home Equity Line of Credit (HELOC) isn't just a loan; it's your opportunity to unlock a lower-interest fund for renovations, debt consolidation, or any unforeseen expenses. Imagine

the freedom of accessing money when needed, with the added perk of potential tax-deductible interest. Turn your home equity from a static asset into an active ally in your financial arsenal. Ready to tap into your home's hidden

value? A HELOC is your key to financial agility and peace of mind.

Reverse Mortgage Loans

Nullam accumsan lorem in dui. Cras ultricies mi eu turpis hendrerit fringilla. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia Curae; In ac dui quis mi consectetuer lacinia. Nam pretium turpis et arcu. Duis arcu tortor, suscipit eget, imperdiet nec, imperdiet iaculis, ipsum. Sed aliquam ultrices mauris. Integer ante arcu, accumsan a, consectetuer eget, posuere ut, mauris. Praesent adipiscing. Phasellus ullamcorper ipsum rutrum nunc. Nunc nonummy metus. Vestibulum volutpat pretium libero. Cras id dui.

Self-Employed Borrowers

Are you a self-employed dreamer stuck in the paperwork nightmare, unable to secure your dream home because your tax write-offs are holding you back? Imagine unlocking the door to your future home with just 10% down and 12 months of bank statements, no traditional income verification hassles. Our bank statement loan custom-tailors your expense ratio, amplifying your purchasing power based on your unique business type. Say goodbye to 'unqualified' and hello to your new home.

Jumbo Loans

Imagine this: You've found the house of your dreams, spacious enough for your growing family, with a view that takes your breath away. But there's a catch - it's priced just beyond the reach of conventional loans. You're now facing a financial crossroads, and the path you choose could either be a gateway to your dream home or a slide into a financial quagmire. Jumbo loans could be your answer, but tread carefully; the stakes are higher than ever. Making the wrong choice could strap you with a burden too heavy to bear. Let's navigate the perilous waters of jumbo loans together, ensuring your dream home doesn't become a financial nightmare.

Borrowers With Considerable Assets

Imagine unlocking the door to your dream home using the wealth you've already built. You've worked hard, saved diligently, and now, even if your income doesn't reflect your assets' full story, there's a path forward. Discover how asset depletion loans can transform your savings into a steady income stream, making your dream home not just a vision, but a reality. Why let traditional income metrics hold you back when your assets can speak volumes? Let's explore how to leverage what you've already achieved to secure your future home.

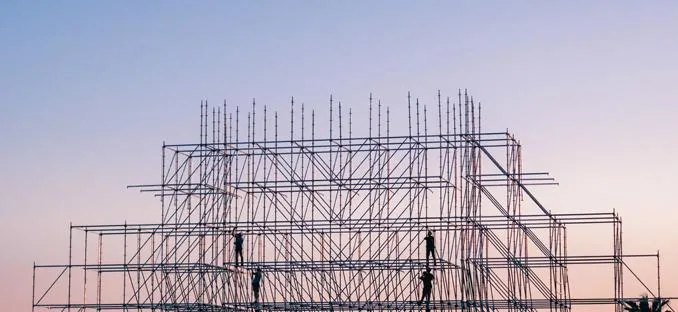

Construction Loans

Imagine the journey of transforming your dream into reality, where every detail of your custom-built home is crafted to perfection, all starting with a seamless financial foundation. With a construction-to-perm loan, embark on this exciting adventure by financing your home's construction and then effortlessly transitioning into a long-term, 30-year mortgage. This single loan simplifies the complex process of home building by eliminating the need for multiple loans, securing your financial peace of mind. From laying the first brick to turning the key in your front door, make your vision come to life without the financial hassle. Don't miss the chance to build your dream home with the financial flexibility and security that a construction-to-perm loan offers!

Real Estate Investors

Struggling to fund your real estate dreams due to outdated lending rules? Fear missing the next big deal. Our investor loans change the game:

Qualify with property rental income, (DSCR)

Finance your Fix and Flip: include not only the cosyt of the property, but also the costs of the renovation.

Bridge the gap to success. Crush those excuses and seize your opportunity now with a short-term Bridge Loan.

ITIN Buyers

Nullam accumsan lorem in dui. Cras ultricies mi eu turpis hendrerit fringilla. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia Curae; In ac dui quis mi consectetuer lacinia. Nam pretium turpis et arcu. Duis arcu tortor, suscipit eget, imperdiet nec, imperdiet iaculis, ipsum. Sed aliquam ultrices mauris. Integer ante arcu, accumsan a, consectetuer eget, posuere ut, mauris. Praesent adipiscing. Phasellus ullamcorper ipsum rutrum nunc. Nunc nonummy metus. Vestibulum volutpat pretium libero. Cras id dui.

Buyers Less than Perfect Credit

Think you can't own a home with a credit score as low as 500 or no down payment? Think again! VA home loans are changing the game for veterans, offering a path to homeownership that many don't realize they have. Don't let this powerful benefit go to waste. Discover how you can step into your dream home with zero down. It's not just a loan; it's your right as a hero. Dive into the untapped potential of VA home loans and turn the key to your future, today!

Renovation Loans

Imagine stepping into a home that’s uniquely yours, crafted to perfection with your vision and a touch of creativity. With a Revolate renovation loan, unlock the potential to purchase a house and transform it into your dream space. Why settle for a finished product that doesn't quite fit when you can customize every detail to match your taste and lifestyle? Get more house, more value, and more satisfaction by choosing a property with potential and turning it into your perfect home. With Revolate, your dream home doesn't have to be a dream anymore—it's your canvas. Invest in a place you can truly call your own and watch your imagination bring it to life, all while maximizing your budget. Discover how a renovation loan can open the door to more possibilities, more house, and more bang for your buck.

1st Time Investor Hack

For aspiring investors eyeing multi-unit properties up to four units with a vision of occupying one as their primary residence, imagine unlocking the door to property investment with minimal financial strain. Picture this: with a VA loan, your investment journey could begin with zero down. Opt for an FHA loan, and only 3.5% down is needed. Even a conventional loan paves the way with just 5% down. Dive into the realm of real estate investment without the weighty upfront financial commitment. Ready to transform your investor dreams into tangible assets? Here's how you can do it with astonishingly low upfront costs.

Western Pioneer Financial

1398 W Herndon Ave #205

Fresno, CA 93711

NMLS# 223537

© Copyright 2024.YourMortgageQB. All rights reserved.